_product_20230530061421.jpg)

We will pay up to S$60,000 per annual for eligible Hospital and Surgical medical expenses at a 4/6-bedded ward at a Singapore Government Restructured Hospital.

We will reimburse up to S$3,000 for funeral expenses incurred if the worker dies from an injury, or illness during / after treatment at a hospital or in day surgery.

We will reimburse up to S$2,000 for expenses incurred to prepare and air transport of the mortal remains from the place of death to the Home Country.

We will pay up to S$10,000 for non-work related injury resulting in death or permanent disablement within 6 months from the date of accident.

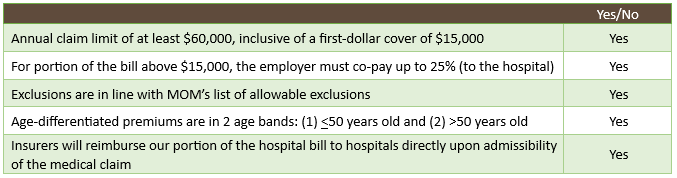

Since 1st January 2010, MOM announced that the minimum insurance coverage required for employer to purchase for their employees (Work Permit & S Pass holders) is S$15,000 per year. And with effect from 31st March 2023, MOM announced that the minimum insurance coverage has increased from S$15,000 to S$60,000 per year. This is to help employers from having to bear the large unexpected medical bills incurred by their employees.

Employers are to borne 25% co-payment for eligible claim amount exceeding the first-dollar cover of S$15,000. However, we do offer an optional cover (at an additional premium) for the waiver of the co-payment by the employer.

Yes. All employers need to furnish the medical insurance details for their Work Permit and S Pass holders via Work Permit Online (WPOL). You are required to furnish the following information:

For more information, you may visit MOM’s website at www.mom.gov.sg or contact MOM's hotline directly at (65) 6438 5122.

MOM allows same policy no. for registration of additional workers. If you encounter any errors in online registration, you may print the screen shot, indicating the error message and fax to MOM at 6532 0795.

We do not allow to backdate the policy commencement date.

Renewal is not guaranteed and the premium rate may change upon renewal.

Pre-existing Conditions are covered upon inception except for Optional Benefits - Outpatient Kidney Dialysis and Cancer Treatment, which are permanently excluded.

However, please note if the Insured Worker has any serious pre-existing condition such as Heart Troubles, Diabetes, Cancer, or Kidney Troubles, etc, please inform us or your intermediary when applying for cover.”

There’s no waiting period of 12 months.

You may refer to this link for the steps of submitting a claim.