EQ Insurance Company Limited is a homegrown general insurance provider.

Established since 2007, we built our initial insurance success through the construction-related industry and have since grown to underwrite all classes of non-life insurances to a diverse group of personal and commercial clients.

Our key business segments are motor, property, casualty, and accident and health insurance. To provide a more holistic suite of products to our clients, we are also underwriting marine (cargo and pleasure craft) and selected specialty lines.

We are a rapidly growing company backed by a proven management team and a strong network of intermediaries, including agents, brokers and financial advisers.

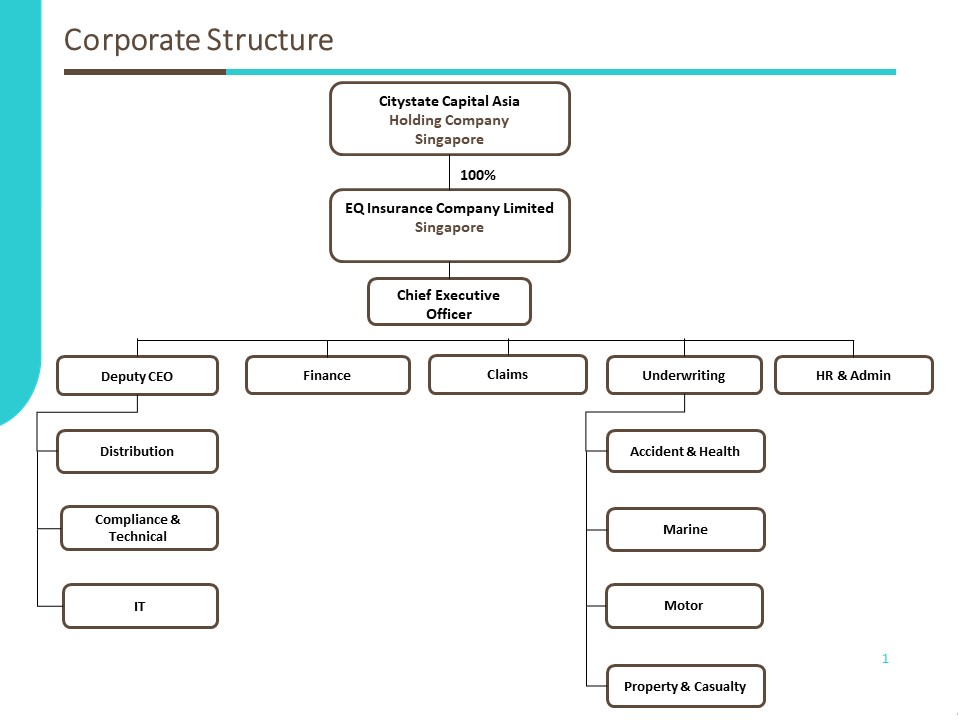

Citystate Capital Asia Pte Ltd owns 100% of EQ Insurance and is headquartered in Singapore. It owns both general insurance companies and insurance brokerage firms, with a presence in Singapore, Indonesia, China and India.